Be Ready for the Unexpected and Guard Your Financial Future

Life is unpredictable — and unexpected costs can crop up just when you least expect them. This is where an emergency fund can help. Surprise car repair, surprise medical bill, or losing your job — having a financial cushion is comforting when life goes off the rails. In this how-to guide, we’ll cover how much you need to save, where to store this fund and how to build it, even if your budget is tight.

💡 What Is an Emergency Fund?

An emergency fund is a special savings fund intended to be used to pay for unexpected or emergency expenses. It keeps you from having to resort to credit cards, overdrafts or high-interest loans in emergencies.

Now, when you’re saving for emergencies, you’re not investing in the long-term or for retirement — your emergency fund is supposed to be both liquid, accessible, and low risk.

💷 How Much Should You Save?

There is no one-size-fits-all answer, but most British financial experts suggest:

- Minimum: £500 to £1,000 for the absolute must-haves (which is a cool starting point)

- Ideal Range: 3 to 6 months of essential living expenses

This includes:

- Rent or mortgage

- Utility bills

- Groceries

- Transport

- Insurance

- Minimum debt repayments

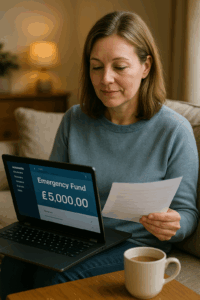

🧮 Example: If your essentials are £1,800 a month, target between £5,400 and £10,800.

📍 Where Should You Keep It?

The ideal home for an emergency fund is a high-interest easy-access savings account. Look for accounts that offer:

- You can withdraw funds at any time, without incurring penalties

- Competitive interest (foresee UK banks or building societies)

- FSCS protection up to £85,000

Don’t tie your emergency fund up in stocks, ISAs with withdrawal penalties or fixed-term savings accounts.

💳 Couldn’t I Just Use a Credit Card?

Despite credit cards being perceived as a last resort, they charge high interest rates and are subject to credit risks. Again, let’s face the facts: borrowing in a financial emergency can deepen your financial hole, especially if you can’t pay it off right away.

You can think of your emergency fund as a debt free option, enabling you to spend more of your time without feeling the burden of needing more money.

🏗️ How to Construct an Emergency Fund (Even on a Tight Budget)

- Begin Small: It helps to have your first target small and manageable – say £500 to £1,000. Every little bit helps.

- Automate Your Savings: Establish a monthly standing order to your emergency pot.

- Cut The Fat: Get rid of old subscriptions or change utility companies.

- Spend Windfalls Wisely: Any tax refund, bonus, or rebate can be directly deposited to your fund.

- Monitor: Use banking apps or spreadsheets to stay motivated.

📱Use apps such as Chip or Monzo’s Pots to automate savings without the pain.

🧠Your Fund Preservation and Protection Tips

- The only time to use it: sincere emergencies (not holidays or sales)

- Restock the toilet paper to make sure that you’re always covered

- Review annually to reflect your current lifestyle and costs

✅ Final Thoughts: Emergency Funds Are a Financial Lifesaver

In today’s uncertain economic environment, establishing an emergency fund is not just good advice — it’s a cornerstone of any solid financial plan. When you’re hit with unforeseen bills – such as larger-than-expected utility bills, unexpected medical bills or new expenses that come with changes to your employment – quick access to emergency cash can make all the difference between you staying in control … and racking up more debt.

Too many British people are driven to credit cards and personal loans in an emergency. But using borrowed money during an emergency can come at a steep cost, especially as interest rates are high or repayment is not immediately feasible. An emergency fund offers a sort of serenity that a line of credit never will — and one that comes without a price.

The great thing about an emergency fund is that it is flexible and personal. You don’t have to save thousands in one night. “If you’re young enough, and let’s face it, by these days you are, you won’t even miss it,” suggests Rob Morgan, pensions and investments analyst at Charles Stanley, so start small — £10, or £25, or £50 a month — then increase as your salary ticks up. Consistency and intention are absolutely key. Even small habits of savings over time can develop into a financial buffer that gives you genuine independence.

It’s also worth reconsidering the fact that emergencies are not always epic catastrophes. From time to time, it’s a busted boiler in the middle of winter, a late paycheck or an emergency car repair. If you have a cushion, you can cope with life’s surprises without getting thrown off your goals or tapping into long-term savings.

Now that you’ve got your emergency fund, safeguard it. Don’t raid it for sales, holidays, or convenience. Only use it when you absolutely need to — and refill it in a hurry.

In the end, emergency funds aren’t about assuming the worst is imminent — they’re about being prepared for such an event. In an ever changing world, financial readiness is one of the most formidable weapons you can possess.

Start constructing your own today — because if we don’t build it now, we might not have the time tomorrow.

Our Post

The Resilient Pound: Navigating the UK’s New Economic Landscape