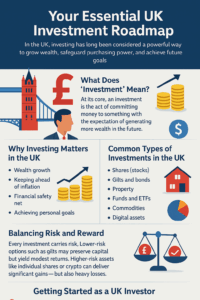

Your Essential UK Investment Roadmap

In the UK, for the longest time, investing has been seen as an effective tool to amass wealth, protect purchasing power and achieve future targets. Though socking money away in a traditional savings account offers safety and accessibility, interest rates tend to trail increases in inflation — so your cash slowly loses purchasing power. It’s why British households, professionals and businesses look to investments: They want their money to work as hard as they do.

This guide will provide you with a complete understanding of how investing in the UK works, the kind of assets that are available for you to invest in, risks you may need to consider and finally a recap of what beginners can do to get started on investing.

What Does “Investment” Mean?

By definition, investing is the practice of laying out money now with the expectation of generating more money in the future. Unlike regular savings accounts which have little growth, investments involve gambling money in places like shares, property or government bonds – all of which can increase in value or offer interest.

Effective investing in the UK isn’t about making a quick buck — it’s about creating sustainable value, hedging against inflation, and unlocking new sources of income over time.

Investing that matters in the UK

- Wealth Growth

Personal investments agglomerate returns along with reinvested income over decades.

- Keeping Ahead of Inflation

Oscillations in UK inflation in recent years have not been unusual. Good investment choices can help protect real value and save money from being eroded over time.

- Financial Safety Net

A balanced portfolio offers stability during periods of economic uncertainty and retirement.

- Achieving Personal Goals

Whether it’s buying that first home in London, paying for children’s education, or laying down the groundwork for a secure retirement, investments can be the building blocks to achieving these things.

Popular UK Investment Types

- Shares (Stocks)

Owning shares means you own a small part of the company. UK investors get dividends and capital gains. Popular starting points include the FTSE 100 and the FTSE 250, although global equities are also available.

- Gilts and Bonds

UK government bonds (‘gilts’) and corporate bonds also provide fixed amounts of interest. They tend to be less risky than stocks and are favored by people who want stability.

- Property

Property is still a staple of UK investing, whether that be buy-to-let, commercial property funds. Property can produce rental income, and act as a hedge against inflation.

- Funds and ETFs

Investors want to be diversified without having to choose individual assets, and mutual funds and Exchange-Traded Funds provide a means to do that. Low cost, available on investment platforms and popular in the UK.

- Commodities

Hedges-investment opportunities: Gold comprises along with oil and agriculture as a possible hedging opportunity, it is a natural financial hedge which come to forefront under circumstances of economic and currency volatility.

- Digital Assets

There are cryptocurrencies such as Bitcoin offered to UK investors, however they are risky and highly volatile. trust should be applied sparingly.

Balancing Risk and Reward

Every investment carries risk. More conservative options, such as gilts, might protect your capital but the returns will be meagre. Higher-risk assets, such as individual shares or crypto, can bring about sizable returns — as well as heavy losses.

UK investors typically build diversified portfolios to distribute risk across a range of asset classes while maintaining a mix of long-term growth and financial stability.

Becoming A UK Investor For UK based Investors is very easy and simple too.

- Specify your objectives – Are you planning for retirement, buying a house or simply investing?

- Know Your Modus Operandi – Learn how much volatility you can bear to get rid of without dropping out.

- Get Your Money In Order – Pay off the essentials, pay down debt and get that emergency fund going before investing.

- Pick a Platform – Go through reputable UK brokers, robo-advisors or ISA (Individual Savings Account) investing platforms for tax efficiency.

- Start Small – Think about index funds, ETFs or diversified funds to get a feel for it before you try more advanced things.

- Keep Learning – Markets evolve. An ongoing education in a form of continuous monitoring helps to refine decisions.

Mistakes to Avoid

- Short Sight – It turns you into someone who makes impromptu bad choices.

- Ignoring Charges & Taxes – Trading charges and Capital Gains Tax can erode returns.

- Trading Based on Emotions – Emotional responses to market volatility typically lead to sidelines.

- No Diversification – It leaves you overexposed to a stock (or property sector) and increases your level of risk.

The Role of Technology in UK Investing

From mobile investment apps to robo-advisors, fintech has made investing more accessible to UK residents than ever before. AI-driven tools, online platforms, and digital banking integrations allow investors to manage global portfolios at their fingertips.

ESG and Sustainable Investing

UK investors are increasingly embracing ESG (Environmental, Social, and Governance) investments. Green bonds, renewable energy funds, and socially responsible companies have become central to many portfolios — allowing individuals to invest with both purpose and profit in mind.

Final Takeaway

Investing in the UK isn’t something exclusive to the rich – anyone can start with discipline, knowledge and the right tools. The sooner you start, the more you can take advantage of compounding growth.

With shares, property or a broader range of funds, British investors are spoilt for choice when it comes to safeguarding your financial future.

Our Post

The Resilient Pound: Navigating the UK’s New Economic Landscape